|

|

VILLAGE FINANCE ISSUES

Budget amendment on July 1 agenda

With three months left in the Village’s fiscal year (ending Sept. 30, 2021), the council on July 1 is being asked in Tab 9 to approve a budget amendment, which aims to reflect changes in the budget by line item based on activity in the fiscal year through May 31, 2021 (which means four months of the budget is to be reflected in a future amendment).

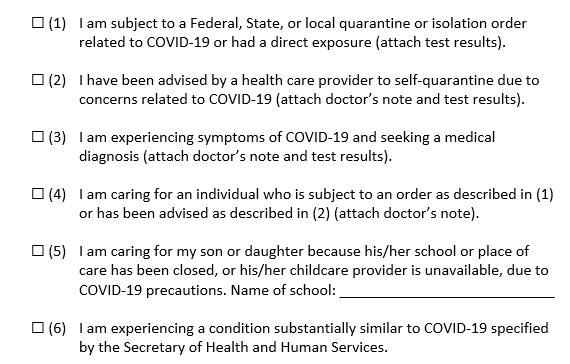

New to this year’s budget, unlike any other year obviously, is that 73 village employees used an average of 42 of federally-paid sick time hours to deal with some aspect of the Coronavirus. Six reasons were allowed by the federal guidelines:

.

.

The council agenda item says, “On Sept. 21, 2020, the Village Council approved the FY 2020-2021 budget through adoption of Resolution No. 20-09-99. The adopting resolution states the budget establishes an initial limitation on expenditures by department or category total and the total sum allocated to each department, category or line item for operating expenses may be increased or decreased by the village manager in accordance with the provisions of the resolution and the village charter. Further, the village manager shall prepare for approval a resolution amending the budget to reflect such department, category or line item reallocation for presentation to the Village Council within 30 days of the date of the reallocation. Due to workload, presentation of a budget amendment within 30 days of each line item change is not possible. The attached resolution serves to memorialize Village Council approval to amend the FY 2020-2021 budget to reflect changes in the budget by line item based on activity in the fiscal year through May 31, 2021.”

The budget may be considered a complicated document but it critically shows the village’s priorities and activities.

Finance Director Maria Bassett’s analysis states, “The budget amendment increases budgeted revenues by $1,184,400. Budgets of individual revenue accounts where receipts to date have exceeded budget are being amended to reflect the revenue increase. As of 5/31/2021, actual revenues are at 91.21% of amended budget, and the benchmark for the point in time is 66.7%. The major portion of ad valorem tax revenues are received at the beginning of the fiscal year and must be applied to cover expenditures over the entire year. As the year progresses, the revenue excess will decrease. A significant contributor to the revenue increase is receipt of $841,000 in COVID-19 CARES Relief funds from the federal government through the state and Monroe County.”

Due to an unusual year with the coronavirus, “a set of accounts was created to account for staff outages due to testing positive for coronavirus or need to quarantine in accordance with guidelines. The budgets for the new accounts are being increased a total of $56,100 for costs incurred through May 31, 2021.”

Bassett further explained, “During the coronavirus pandemic, the federal government required employers provide what it referred to as ‘federal sick leave’ up to 80 hours for employees to be used for coronavirus-related incidents. The federal sick leave expires September 30, 2021. For instance, if an employee woke up with a fever and had concerns they had coronavirus and needed to get tested, they received this special sick time to be able to get tested, wait for the results, confirm they are no longer contagious, etc., instead of using personal sick leave. We accounted for and tracked the use of this sick time separately in case an opportunity for reimbursement of some type arose. The $56,100 was spent on employee compensation whenever employees utilized the federal sick leave for coronavirus. If an employee was sick for an extended period of time with coronavirus, then they were able to use the additional 80 hours of federal sick leave first and then use their own sick leave. The leave was also available if an employee thought they had been exposed while they awaited test results to avoid them coming into work and potentially exposing others.”

“Ultimately, this is one of the expenses the CARES Act funding that we received in the amount of $841,000 was intended for.”

Evie Engelmeyer, human resources manager & ADA coordinator, further explained. “Currently, we have 73 employees that used paid federal sick leave hours. As of July 1, there have been 3,061.75 hours of paid federal sick leave used. Please keep in mind that does not exactly correlate with employees that had/have COVID."

From large to small, Bassett patiently explains discrepancies in what was budgeted and what was spent. An example of a “small” expense over the budgeted amount occurred in the Finance and Administration Department, namely, $500 in the Dues and Subscriptions account. Bassett said, “Each year we pay Annual Service Maintenance (ASM) fees to providers of our various software applications. For the finance department software (Incode 10 from Tyler Technologies), we included $20,000 in the Dues and Subscriptions account where the total original budget was $24,000. Our payment to Tyler Technologies for the ASM fees, fees for their disaster recovery service and fees for the timeclock application totaled $23,053. With other expenses to the account, by 5/31/2021, we are over the $24,000 total budget. Therefore, I am requesting $500 at this time. By the end of the year, we may need to request more funds in this account or we can look at transferring funds from another account.”

It is time-consuming to pore over any municipal budget and understand the small and large numbers but it is incumbent on residents to do that. That old saying, "Trust, but verify” helps ensure fewer monetary surprises and/or questionable expenses. And, in the end, it’s our money, residents' money, and needs to be spent wisely.

See July 1 Tab 9 budget amendment here.

In the Comprehensive Annual Financial Report for the year ended September 30, 2020, there are no [negative] findings as reflected on pages 101 and 102, which provide a Summary of Audit Results.

The Independent Auditor’s Management Letter on pages 103 and 104 include no management letter comments or recommendations to improve financial management. The Management Letter further confirms the Village met none of the conditions specified in Florida Statutes to indicate the Village is in poor financial condition. The auditors will make a presentation at either the July 22 or the Aug. 19 village council meeting.

See the village CAFRs for 20i8-2020 here.